US Tuberculosis Treatment Market

Source: The Report Cube

Understand The Key Trends Shaping This Market

Download Free SampleUS Tuberculosis Treatment Market Insights & Analysis

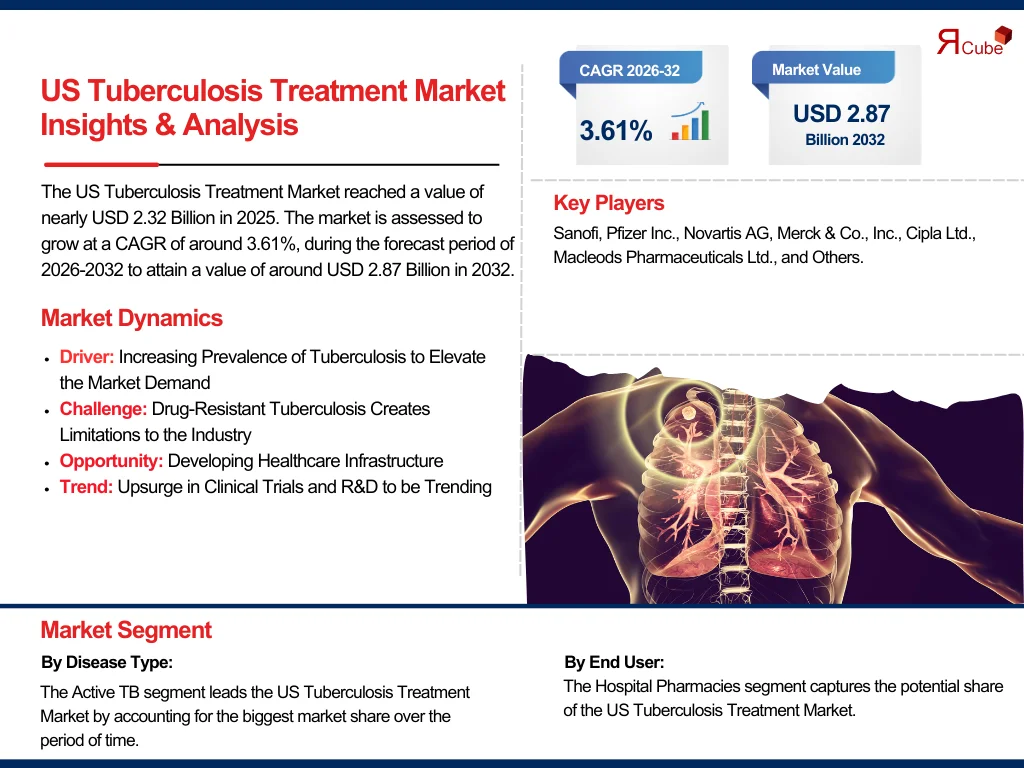

The US Tuberculosis Treatment Market reached a value of nearly USD 2.32 Billion in 2025. The market is assessed to grow at a CAGR of around 3.61%, during the forecast period of 2026-2032 to attain a value of around USD 2.87 Billion in 2032. The industry of tuberculosis (TB) treatment is motivated by the increasing occurrence of tuberculosis & rising awareness of drug-resistant TB strains. Though the US records comparatively fewer TB cases than several other developing countries, encounters like multidrug-resistant TB & latent infections remain serious public health concerns.

The US Tuberculosis Treatment Market also includes anti-TB drugs, diagnostics, and combination therapies custom-made for active & latent tuberculosis TB infections. Also, products are generally distributed through hospital & retail pharmacy channels, with an increasing presence in online pharmacies. Further, the surge in investments in clinical trials & collaborations among leading competitors, including Pfizer, Sanofi, and Macleodsa Pharmaceuticals Ltd., is enhancing treatment progressions.

Additionally, as per the World Health Organization, the country has made substantial developments in TB control, but evolving drug resistance & non-compliance with long treatment regimens present a barrier. However, to combat this, new-generation anti-TB drugs with shorter treatment intervals & enhanced efficiency are under development, thus contributing to improving the US Tuberculosis Treatment Market share.

Furthermore, the US Tuberculosis Treatment Market is expected to be fueled by developments in healthcare infrastructure, constant government support for public health initiatives, and growing awareness about TB treatment adherence. Besides, personalized medicine & quick molecular diagnostics are transforming the landscape for tuberculosis TB management.

Further, with innovations such as rifapentine-based regimens & treatment monitoring apps, the US Tuberculosis Treatment Industry outlook remains positive during the forthcoming period. Also, as novel drug combinations get FDA approval & awareness campaigns strengthen, the market size for TB treatment is destined to expand swiftly across the United States in the future years.

US Tuberculosis Treatment Market Upgrades & Recent Developments (2025)

- Sanofi introduced a joint program with the CDC to support treatment adherence for drug-resistant TB utilizing digital pill-tracking solutions.

- Pfizer Inc. commenced a Phase II clinical trial assessing a novel anti-mycobacterial agent effective against multidrug-resistant TB, targeting to expand its infectious disease portfolio.

- Merck & Co., Inc. declared plans to invest in TB-focused R&D as part of its global public health commitment.

- Cipla Ltd. extended its presence in North America by accumulating the supply of fixed-dose combination anti-TB drugs to government-run hospitals.

US Tuberculosis Treatment Market Dynamics

-

Driver: Increasing Prevalence of Tuberculosis to Elevate the Market Demand

The US, a developed nation, is still witnessing a steady surge in TB incidence, specifically among immunocompromised & foreign-born individuals. Also, TB treatment programs & related medications are increasing as a result of the growing incidence of TB.

-

Challenge: Drug-Resistant Tuberculosis Creates Limitations to the Industry

The US Tuberculosis Treatment Market faces substantial challenges owing to the rising incidence of drug-resistant TB, such as multidrug-resistant TB. These Mycobacterium tuberculosis strains also need new drug development & longer treatment durations, making them more challenging & expensive to treat.

-

Opportunity: Developing Healthcare Infrastructure

Owing to constant expenditures in healthcare infrastructure, the country is in a decent position to improve early detection, prompt treatment, and follow-up care for tuberculosis. As a result, it presents growth opportunities for the leading market companies.

-

Trend: Upsurge in Clinical Trials and R&D to be Trending

A rise in clinical trials aiming at novel anti-TB drugs & combination therapies reflects a growing commitment by leading companies to tackle drug resistance & improve treatment efficiency in the forecast years.

US Tuberculosis Treatment Market Segment-Wise Analysis

By Disease Type:

- Active TB

- Latent TB

The Active TB segment leads the US Tuberculosis Treatment Market by accounting for the biggest market share over the period of time. This is attributed to the augmented risk of transmission & more intricate treatment requirements. A lengthy multi-drug regimen & severe adherence are often essential for the management of active tuberculosis TB, which elevates the demand for novel & effective TB treatment approaches.

Also, to reduce the spread of tuberculosis, public health surveillance systems in the US place a strong emphasis on detecting & treating active cases. Also, advanced anti-TB medications & supportive care infrastructure are needed as active cases of TB are more likely to have drug-resistant TB.

By End User:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

The Hospital Pharmacies segment captures the potential share of the US Tuberculosis Treatment Market. The key distribution hubs for intensive TB therapy are these pharmacies, specifically for patients with co-morbidities & drug-resistant TB. As hospital settings manage most complex clinical studies & inpatient TB cases, this industry benefits from elevated volumes & specialist drug inventory. Also, TB drugs are often supplied by the government & public health initiatives via hospital channels, which strengthens this segment's domination.

Throughout 2032, hospital pharmacies would continue to play a vital role in guaranteeing access to robust, regulated anti-TB medications as treatment guidelines alter & mycobacterium tuberculosis strains become more resistant. Thus, this would maintain stable market trends & development.

What Does Our US Tuberculosis Treatment Market Research Study Entail?

- The US Tuberculosis Treatment Market Research Report highlights the forecast growth rate (CAGR) by anticipating the market size and share.

- The market analysis puts light upon the primary industry trends, driving aspects, potential opportunities, growth challenges, and other major factors.

- The US Tuberculosis Treatment Market Research Report entails details about the most critical shifts in market share in the prominent regions.

- Considering the statistics & the developments by the primary market competitors, our report also strives to demonstrate the most sought-after strategies of the key players.

Table of Contents

- Introduction

- Objective of the study

- Product Definition

- Market Segmentation

- Study Variables

- Research Methodology

- Secondary Data Points

- Companies Interviewed

- Primary Data Points

- Break Down of Primary Interviews

- Secondary Data Points

- Executive Summary

- Market Dynamics

- Drivers

- Challenges

- Opportunity Assessment

- Recent Trends and Developments

- Policy and Regulatory Landscape

- US Tuberculosis Treatment Market Overview (2020-2032)

- Market Size, By Value (in USD Billions)

- Market Share, By Disease Type

- Active TB

- Latent TB

- Market Share, By End User

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

- Market Share, By Route of Administration

- Oral

- Parenteral

- Others

- Market Share, By Dosage Form

- Tablets

- Capsules

- Injections

- Others

- Market Share, By Therapy

- First-Line Therapy

- Second-Line Therapy

- Market Share, By Competitors

- Competition Characteristics

- Revenue Shares

- US Active TB Tuberculosis Treatment Market Overview, 2020-2032F

- By Value (USD Million)

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Route of Administration- Market Size & Forecast 2019-2030, USD Million

- By Dosage Form- Market Size & Forecast 2019-2030, USD Million

- US Latent TB Tuberculosis Treatment Market Overview, 2020-2032F

- By Value (USD Million)

- By End User- Market Size & Forecast 2019-2030, USD Million

- By Route of Administration- Market Size & Forecast 2019-2030, USD Million

- By Dosage Form- Market Size & Forecast 2019-2030, USD Million

- Competitive Outlook (Company Profile - Partila List)

- Sanofi

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Pfizer Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Novartis AG

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Merck & Co., Inc.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Cipla Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Macleods Pharmaceuticals Ltd.

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Others

- Company Overview

- Business Segments

- Strategic Alliances/Partnerships

- Recent Developments

- Sanofi

- Contact Us & Disclaimer

List of Figure

Introduction

-

Figure 1: Study Objective Framework

-

Figure 2: Product Definition Overview

-

Figure 3: Market Segmentation Structure

-

Figure 4: Study Variables Outline

-

Figure 5: Research Methodology Flowchart

-

Figure 6: Secondary Data Sources

-

Figure 7: Companies Interviewed by Sector

-

Figure 8: Primary Data Points Distribution

-

Figure 9: Breakdown of Primary Interviews

Executive Summary

-

Figure 10: Key Market Dynamics Overview

-

Figure 11: Major Market Drivers

-

Figure 12: Market Challenges

-

Figure 13: Opportunity Assessment Matrix

-

Figure 14: Recent Trends and Developments Timeline

-

Figure 15: Policy and Regulatory Landscape Summary

US Tuberculosis Treatment Market Overview (2020-2032)

-

Figure 16: Market Size by Value (USD Billions)

-

Figure 17: Market Share by Disease Type

-

Figure 18: Active TB Market Share

-

Figure 19: Latent TB Market Share

Market Share by End User

-

Figure 20: Hospital Pharmacies Market Share

-

Figure 21: Retail Pharmacies Market Share

-

Figure 22: Online Pharmacies Market Share

-

Figure 23: Others Market Share

Market Share by Route of Administration

-

Figure 24: Oral Administration Market Share

-

Figure 25: Parenteral Administration Market Share

-

Figure 26: Others Route Market Share

Market Share by Dosage Form

-

Figure 27: Tablets Market Share

-

Figure 28: Capsules Market Share

-

Figure 29: Injections Market Share

-

Figure 30: Others Dosage Forms Market Share

Market Share by Therapy

-

Figure 31: First-Line Therapy Market Share

-

Figure 32: Second-Line Therapy Market Share

Market Share by Competitors

-

Figure 33: Competition Characteristics

-

Figure 34: Revenue Shares of Key Players

US Active TB Tuberculosis Treatment Market Overview (2020-2032F)

-

Figure 35: Market Value (USD Million)

-

Figure 36: Market Size & Forecast by End User (2019-2030)

-

Figure 37: Market Size & Forecast by Route of Administration (2019-2030)

-

Figure 38: Market Size & Forecast by Dosage Form (2019-2030)

US Latent TB Tuberculosis Treatment Market Overview (2020-2032F)

-

Figure 39: Market Value (USD Million)

-

Figure 40: Market Size & Forecast by End User (2019-2030)

-

Figure 41: Market Size & Forecast by Route of Administration (2019-2030)

-

Figure 42: Market Size & Forecast by Dosage Form (2019-2030)

Competitive Outlook (Company Profiles)

-

Figure 43: Sanofi - Business Segments Overview

-

Figure 44: Sanofi - Strategic Alliances & Partnerships

-

Figure 45: Sanofi - Recent Developments Timeline

-

Figure 46: Pfizer Inc. - Business Segments Overview

-

Figure 47: Pfizer Inc. - Strategic Alliances & Partnerships

-

Figure 48: Pfizer Inc. - Recent Developments Timeline

-

Figure 49: Novartis AG - Business Segments Overview

-

Figure 50: Novartis AG - Strategic Alliances & Partnerships

-

Figure 51: Novartis AG - Recent Developments Timeline

-

Figure 52: Merck & Co., Inc. - Business Segments Overview

-

Figure 53: Merck & Co., Inc. - Strategic Alliances & Partnerships

-

Figure 54: Merck & Co., Inc. - Recent Developments Timeline

-

Figure 55: Cipla Ltd. - Business Segments Overview

-

Figure 56: Cipla Ltd. - Strategic Alliances & Partnerships

-

Figure 57: Cipla Ltd. - Recent Developments Timeline

-

Figure 58: Macleods Pharmaceuticals Ltd. - Business Segments Overview

-

Figure 59: Macleods Pharmaceuticals Ltd. - Strategic Alliances & Partnerships

-

Figure 60: Macleods Pharmaceuticals Ltd. - Recent Developments Timeline

-

Figure 61: Other Companies Overview

-

Figure 62: Other Companies Strategic Alliances & Partnerships

-

Figure 63: Other Companies Recent Developments

List of Table

Introduction

-

Table 1: Study Objectives Summary

-

Table 2: Product Definitions and Classifications

-

Table 3: Market Segmentation Criteria

-

Table 4: Key Study Variables

-

Table 5: Research Methodology Details

-

Table 6: Secondary Data Sources and References

-

Table 7: List of Companies Interviewed

-

Table 8: Primary Data Points Summary

-

Table 9: Breakdown of Primary Interviews by Type

Executive Summary

-

Table 10: Market Drivers and Impact Analysis

-

Table 11: Challenges Affecting Market Growth

-

Table 12: Opportunity Assessment Highlights

-

Table 13: Recent Trends and Developments

-

Table 14: Summary of Policy and Regulatory Landscape

US Tuberculosis Treatment Market Overview (2020-2032)

-

Table 15: Market Size Forecast by Year (USD Billions)

-

Table 16: Market Share by Disease Type (%)

-

Table 17: Active TB Market Share Details

-

Table 18: Latent TB Market Share Details

Market Share by End User

-

Table 19: Market Share Distribution – Hospital Pharmacies (%)

-

Table 20: Market Share Distribution – Retail Pharmacies (%)

-

Table 21: Market Share Distribution – Online Pharmacies (%)

-

Table 22: Market Share Distribution – Others (%)

Market Share by Route of Administration

-

Table 23: Oral Administration Market Share (%)

-

Table 24: Parenteral Administration Market Share (%)

-

Table 25: Others Route Market Share (%)

Market Share by Dosage Form

-

Table 26: Tablets Market Share (%)

-

Table 27: Capsules Market Share (%)

-

Table 28: Injections Market Share (%)

-

Table 29: Others Dosage Forms Market Share (%)

Market Share by Therapy

-

Table 30: First-Line Therapy Market Share (%)

-

Table 31: Second-Line Therapy Market Share (%)

Market Share by Competitors

-

Table 32: Competition Characteristics Summary

-

Table 33: Revenue Shares of Key Players (%)

US Active TB Tuberculosis Treatment Market Overview (2020-2032F)

-

Table 34: Market Size and Forecast by Value (USD Million)

-

Table 35: Market Size & Forecast by End User (2019-2030)

-

Table 36: Market Size & Forecast by Route of Administration (2019-2030)

-

Table 37: Market Size & Forecast by Dosage Form (2019-2030)

US Latent TB Tuberculosis Treatment Market Overview (2020-2032F)

-

Table 38: Market Size and Forecast by Value (USD Million)

-

Table 39: Market Size & Forecast by End User (2019-2030)

-

Table 40: Market Size & Forecast by Route of Administration (2019-2030)

-

Table 41: Market Size & Forecast by Dosage Form (2019-2030)

Competitive Outlook (Company Profiles)

-

Table 42: Sanofi – Company Overview and Business Segments

-

Table 43: Sanofi – Strategic Alliances and Partnerships

-

Table 44: Sanofi – Recent Developments

-

Table 45: Pfizer Inc. – Company Overview and Business Segments

-

Table 46: Pfizer Inc. – Strategic Alliances and Partnerships

-

Table 47: Pfizer Inc. – Recent Developments

-

Table 48: Novartis AG – Company Overview and Business Segments

-

Table 49: Novartis AG – Strategic Alliances and Partnerships

-

Table 50: Novartis AG – Recent Developments

-

Table 51: Merck & Co., Inc. – Company Overview and Business Segments

-

Table 52: Merck & Co., Inc. – Strategic Alliances and Partnerships

-

Table 53: Merck & Co., Inc. – Recent Developments

-

Table 54: Cipla Ltd. – Company Overview and Business Segments

-

Table 55: Cipla Ltd. – Strategic Alliances and Partnerships

-

Table 56: Cipla Ltd. – Recent Developments

-

Table 57: Macleods Pharmaceuticals Ltd. – Company Overview and Business Segments

-

Table 58: Macleods Pharmaceuticals Ltd. – Strategic Alliances and Partnerships

-

Table 59: Macleods Pharmaceuticals Ltd. – Recent Developments

-

Table 60: Others – Company Overview and Business Segments

-

Table 61: Others – Strategic Alliances and Partnerships

-

Table 62: Others – Recent Developments

Top Key Players & Market Share Outlook

- Sanofi

- Pfizer Inc.

- Novartis AG

- Merck & Co., Inc.

- Cipla Ltd.

- Macleods Pharmaceuticals Ltd.

- Others

Frequently Asked Questions